can you pay your car insurance deductible with a credit card

Hit-and-run car accidents will not cause your car insurance rates to go up. Best car insurance discounts.

Otherwise figure your deductible mortgage insurance premiums for the current year using the rules explained under Mortgage Insurance Premiums in Part I.

. You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. You can also call the credit card company you will be using to pay for the car rental. Your auto insurance may provide coverage for rental cars.

Instead you will need to set up a payment plan with a mechanic take out a loan or save up until you can afford the deductible. In most covered loss cases you are responsible for any amounts up to your deductible level and your insurance would cover anything beyond that up to your coverage limit. 2 If you pay average insurance rates thats up to 480 a year.

Still you must typically pay your policys deductible and any claims may cause your rates to go up. Collision rates are higher for drivers under age 25 especially single males. Car insurance is tax deductible as part of a list of expenses for certain individuals.

A percentage-- Percentage-based is when your deductible is a percentage of your insurance policys total coverage amount. If your plan has a 100 deductible and 30 co-insurance and you use 1000 in services youll pay the 100 plus 30 of the remaining 900 up to your out-of-pocket maximum. Buying extra rental car insurance may not make financial sense if your auto policy already provides the coverage you.

You can make a lot of money on Turo. So if your home is insured for 200000 and your deductible is 2 youd have to pay the first 4000 of any claim. It takes some time but the more you use the platform the more.

Maintaining good credit may have a positive impact on your car insurance costs. If you use a credit card include medical expenses you charge to your credit card in the year the charge is made not when you actually pay the amount charged. But youll have to pay a higher deductible in the event you have to manage a damage claim and request reimbursement.

For the coverage to apply you usually must reserve and pay for the rental car using that card. If you get into an accident you have to pay for all the damages out of pocket. With a little time you could find the best policy with multiple car insurance discounts for your own needs.

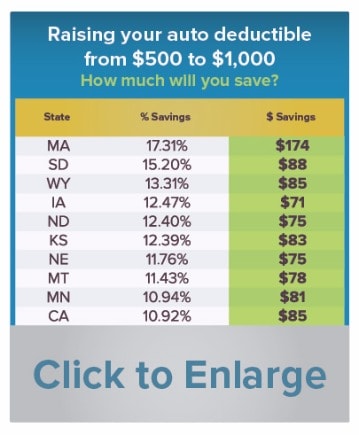

Raising your deductible to 1000 could save you 40 or even more on your premiums. Generally people who are self-employed can deduct car insurance but there are a few other specific individuals for whom car insurance is tax deductible such as for armed forces reservists or qualified performing artists. In a worst.

It could mean your credit card bills and other financial obligations along with your car insurance premiums are straining your budget. Claiming your deductible mortgage insurance premiums. A car insurance quote estimates the premium youll pay for a car insurance policy.

Seek help from a certified credit. Every insurer uses a unique formula to calculate your personal car insurance quote so even if you provide the same information to different insurance. Youre worried about having to pay a deductible or a higher rate on your auto insurance if you damage a rental car.

You may find plans with no co-insurance requirements some with 2080 or 5050 coinsurance or other combinations. Typically you must pay for the rental with the credit card that includes the benefit and you must decline the rental car companys collision. If you cant pay your car insurance deductible you wont be able to file a car insurance claim to have vehicle damage or medical bills paid for by your insurance company.

But if youre facing a situation where you may not have a future if you cant pay your health insurance deductible then you might consider this an option. If you cant afford car insurance you cant drive. Your age sex and marital status.

Once you get a quote from a lender run the numbers to see if it. Driving without insurance is illegal in most states and getting caught driving without insurance can really set you back. You dont have your own car insurance or coverage through a credit card.

The Bottom Line It doesnt matter if you own a Tesla Ford BMW Pontiac or the classic Toyota Camry. So youve tried some of those cost-cutting moves but youre still struggling. If you didnt claim a medical or dental expense that would have been deductible in an earlier year you can file Form 1040-X Amended US.

By choosing to take money from your retirement to pay your health insurance deductible youre borrowing from your future to pay for your present. Whether your insurance will cover the person driving your car often comes down to whether they are a permissive or non-permissive user. Some credit cards provide additional coverage but make sure you understand the terms and conditions.

Many credit cards come with rental car insurance as a benefit which can supplement or even serve in place of your regular auto insurance policy. To find out call GEICO to see if rental cars are covered by your current auto insurance policy. Your car insurance policy outlines who has permission to drive your car and who doesnt and some policies may even explicitly state that no one besides you is covered when driving your car.

On the other hand in the case of an accident that you did not. This isnt a very good long-term plan. Individual Income Tax Return to claim a refund for the year in which you.

Before you rent a car take a few minutes to find out whether you have coverage through existing channels such as your credit card company health insurance plan or renters or homeowners policy. Insurance prices in most states reflect these. Credit Card Reviews.

To get a handle on your finances you might. The contributions you make to a retirement plan such as a 401k plan or traditional or Roth IRA gives you a tax credit of 50 20 or 10 depending on your adjusted gross income that you report. You can file a claim for car repairs under the collision insurance portion of.

If your AGI on Form 1040 or 1040-SR line 11 is more than 109000 54500 if married filing separately you cannot deduct your mortgage insurance premiums. We recommend saving up a beginner emergency fund of 1000 or a sinking fund so you can afford that higher deductible and enjoy lower premiums. Besides paying heavy fines you could lose your license and registration.

And be sure to check your personal car insurance coverage. The quote is calculated using the information you provide such as your age the car you drive your driving history and your postal code. Pay-per-mile insurance from Metromile.

For example if you select a 1000 deductible and have a 4200 covered loss you would receive a claim payment of 3200 after deducting the 1000. Car Rental Secrets We Bet You. Where applicable many insurance companies use credit history to help determine the cost of car insurance.

Car insurance is required by law in almost every state. How to Get Financial Help With Car Insurance. If your deductible is 1000 you pay that amount and your homeowners insurance company takes care of the remaining 2000.

Is Car Insurance Tax Deductible H R Block

Credit Cards With Primary Car Rental Insurance Coverage Travelsort Rental Insurance Car Rental Rental

Raise Deductible To Save On Auto Insurance Insurancequotes

Raise Your Car Insurance Deductible To Save Up To 28 Insurancequotes

Can I Pay My Car Insurance Deductible With A Credit Card Insurance Panda

Compare Home Insurance Quotes And Rates 2021 Insurance Com Home Insurance Home Insurance Quotes Insurance Deductible

How To Avoid Paying A Car Insurance Deductible

What Is A Car Insurance Deductible Bankrate

Full Coverage Auto Insurance Understanding Your Car Insurance Declarations Page Full Coverage Auto Car Insurance Home Insurance Quotes Car Insurance Rates