ev tax credit 2022 texas

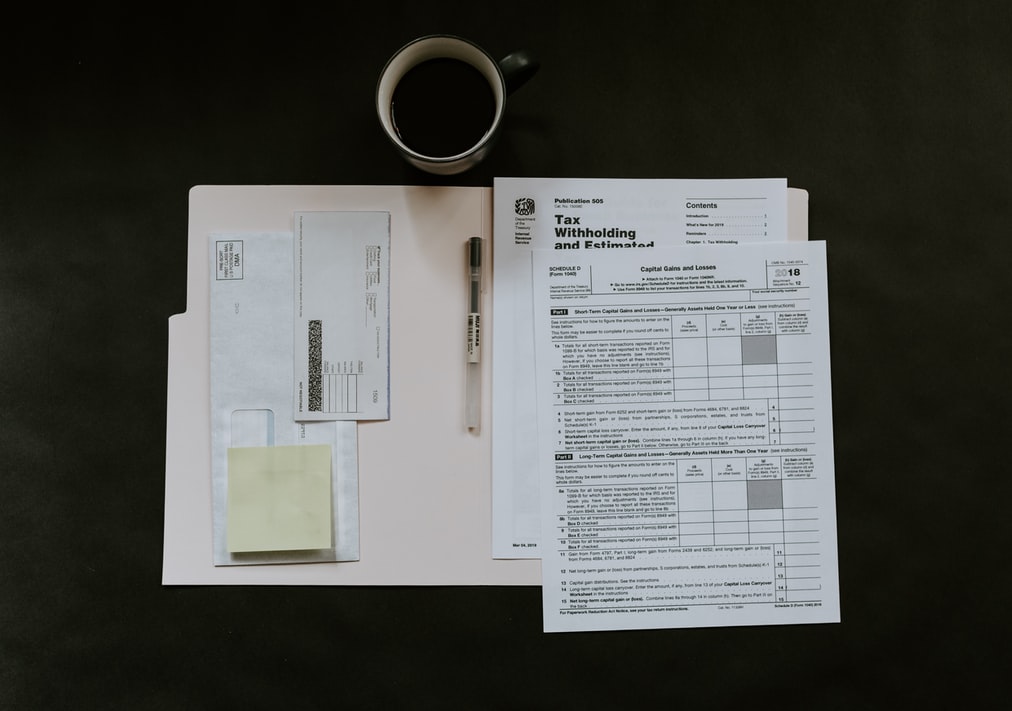

The dates above reflect the extension. How to Apply Step 1.

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

Batteries For a Range Of Lifestyles.

. Download and complete the application andor reservation form Step 4. Thursday February 10 2022 AUSTIN Texas -- The US. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery.

Department of Transportation announced Thursday that Texas is eligible to receive 60356706 for electric vehicle EV charging. The US Federal tax credit is up to 7500 for an buying electric car. The incentives had been proposed to go as high as.

The State of Texas offers a 2500 rebate for buying an electric car. The credit is for. If you have questions call 512 370-8243.

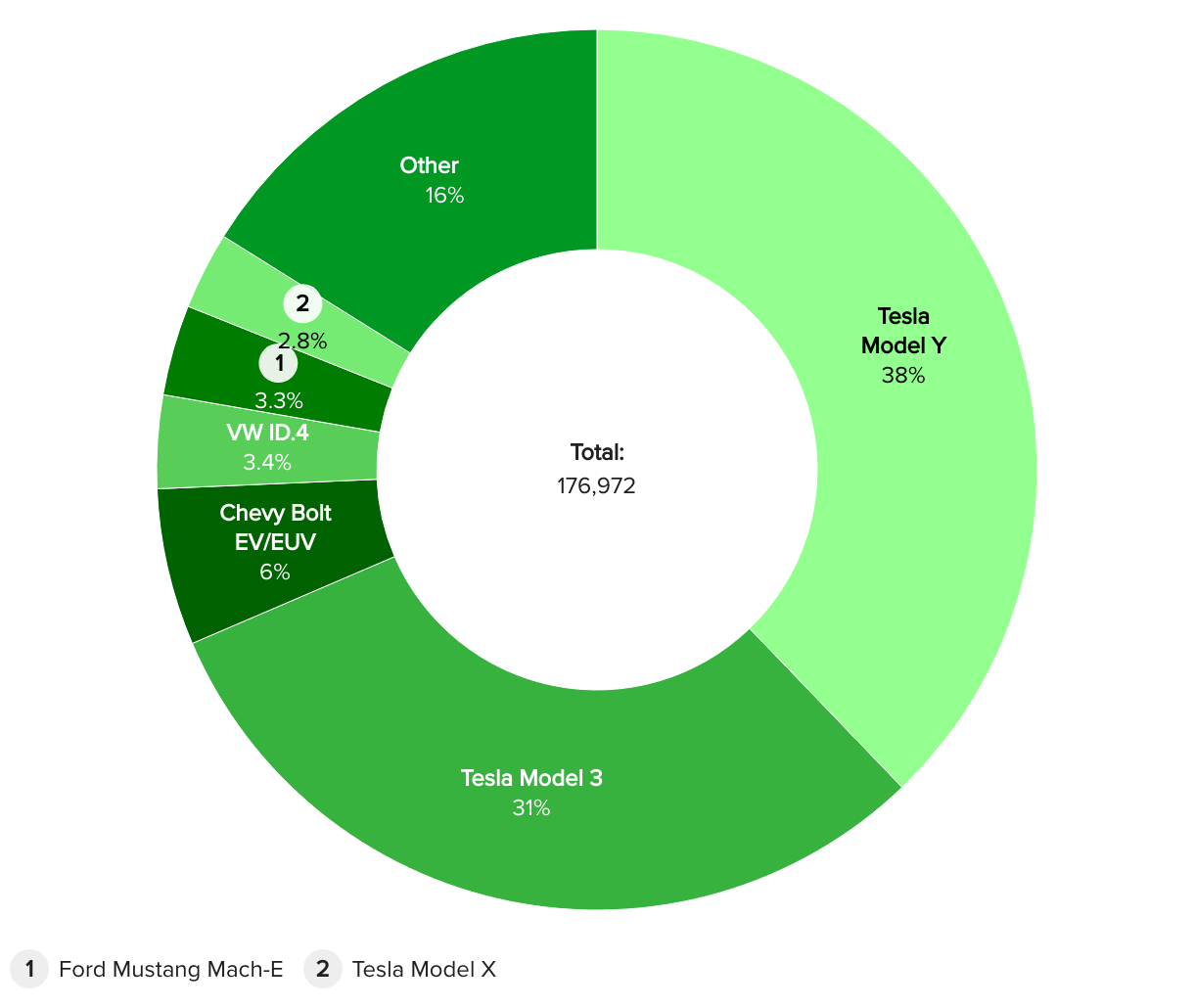

Latest On Tesla Ev Tax Credit January 2022 Tips For Electric Vehicle Drivers In Texas Latest On Tesla Ev Tax Credit January 2022. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. Ad Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

Back to Top State Local. Ad Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Ev tax credit 2022 texas Sunday February 13 2022 Edit.

How Electric Vehicle Tax Credits Work Going Green States With The Best Electric Vehicle Tax Incentives The Zebra Tips For Electric. For every kilowatt-hour of capacity. This incentive is not a check you receive in the mail following a vehicle purchase but rather a.

Plug-In Electric Vehicle PEV Tax Credit. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. The EV tax credit is a federal incentive built to encourage drivers to purchase an electric vehicle.

421 rows Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Ad Build Price Locate a Dealer in Your Area. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar.

Find Your 2021 Nissan Now. Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal.

50 of purchase and. Various utility companies in the state offer rebates for. Available until January 1 2026.

Get More Power Than Ever With a Nissan Electric Car. The largest is the Light-Duty Alternative Fuel Vehicle Rebate which offers a credit of up to 2500 for buying an electric vehicle or plug in hybrid. Texas EV Rebate Program 2000 applications accepted per year.

Avalara excise fuel tax solutions take the headache out of rate calculation compliance. The eligibility standards in Texas Health and Safety Code Chapter 386 and 30 Texas Administrative Code Chapter 114 and must be included on the TCEQ LDPLIP Eligible. Texas state senators are.

At the end of 2021 183000 EV and PHEV Toyotas qualified for the federal tax credit with another 8421 cars added to the ledger at the end of the first quarter of 2022 according to. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Determine if you are eligible Step 2.

The plug-in hybrid electric vehicle rebate expires December 31 2022 and all-electric vehicle rebates expire June 30 2030. We cant rely on gas taxes forever but theres no simple obvious way to integrate electric vehicles and other alternative-fuel vehicles into the funding structure. IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500 The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive.

Ev tax credit 2022 texas Friday June 10 2022 Edit. Honda Civic GX Rebates Texas Gas Service offers. Review the application instructions Step 3.

However the credit is worth up to 7500 depending on the size of the battery. This incentive covers 30 of the cost with a. Keep in mind that Texas Gas Service offers these rebates on a first-come first-served basis until funds run out.

Tesla Model X Features Price Specs Release Date Electrek

Tesla Q1 Earnings Call 2022 Transcript Rev

The Best Section 179 Vehicles For 2022 Shared Economy Tax

Is There An Ev Tax Credit For The 2022 F 150 Lightning Vance Country Ford Blog

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Electric Vehicle Charging Rebate Massachusetts 2022

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Ev Charging Station Incentives In New York Ev Connect

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Model X Features Price Specs Release Date Electrek

2022 Illinois Solar Incentives Guide Tax Credits Rebates More

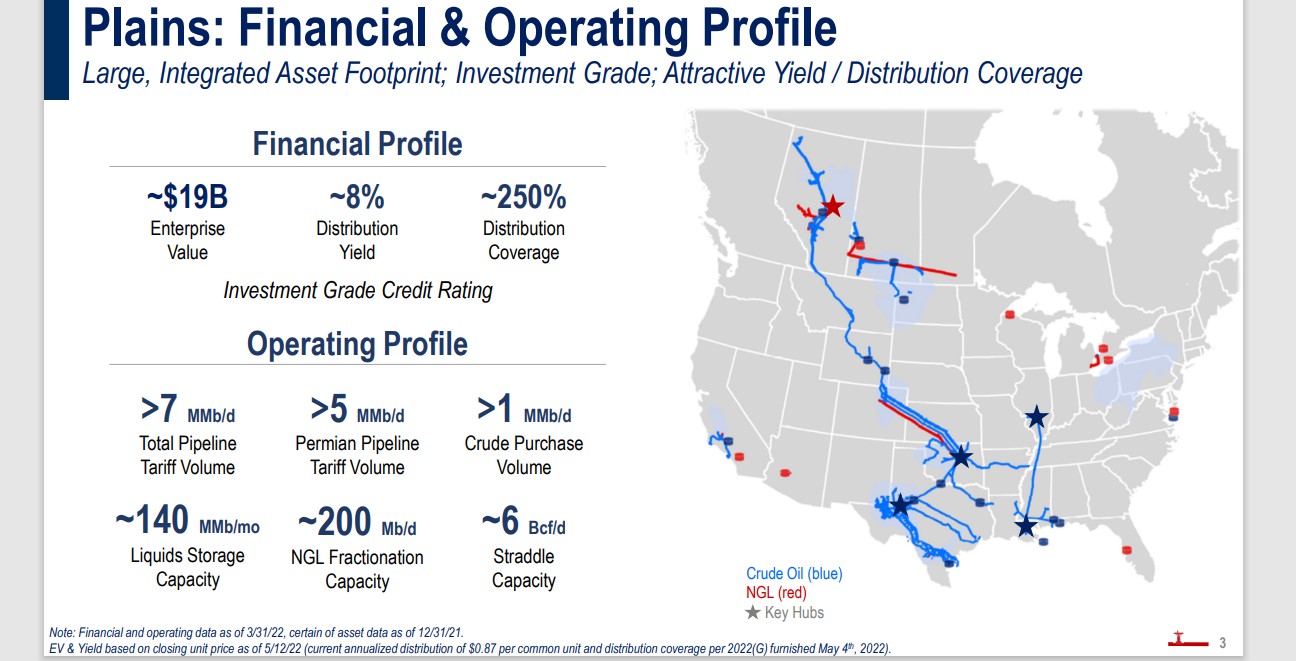

2022 Mlp List Yields Up To 15 1 Updated Daily

Is There An Ev Tax Credit For The 2022 F 150 Lightning Vance Country Ford Blog

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

2022 Ford Mach E Gt 84 Month Financing Rate Slashed Carsdirect